Republished with permission from Built to Sell Inc.

Have you ever noticed that fire trucks always back into the fire hall?

Why don’t they just pull into their parking spot snout-forward like the rest of us?

Backing in at the end of a shift saves them time when they have to get to a fire. They back in to be ready; whether the call comes in 5 minutes or 5 days, they are prepared to pull out as quickly as possible.

Photo by: Lee Cannon licensed under Creative Commons Attribution 2.0 Generic

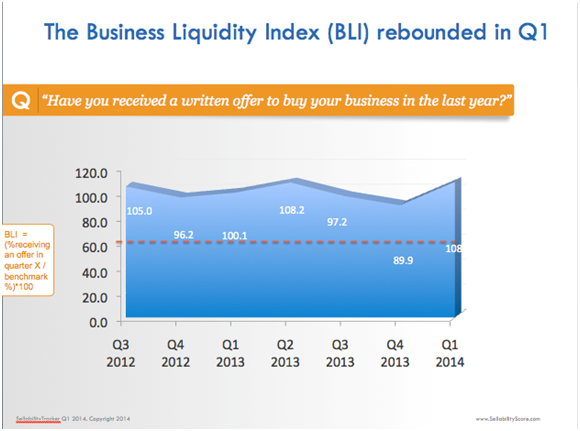

Like the firemen, you, as a business owner, need to be ready when you get the call from someone who wants to buy your business. And these days, owners are getting that call more often. According to the latest Sellability Tracker report, the proportion of business owners who received an offer to buy their company in the quarter ending March 31, 2014 was up considerably from Q4 2013. Roughly 12% of business owners using The Sellability Score last quarter had recently received an offer to buy their business.

The proportion of owners getting an offer is an important statistic because it measures one half of the equation of a business sale. For a transaction to take place, there must be both a willing seller and a willing buyer.

Companies are becoming more acquisitive because they have access to more cash than they know what to do with. Interest rates are next to nothing, and after the liquidity crisis of 2008, companies have been socking away profits on their balance sheet for a rainy day.

This increase in acquisitiveness among buyers has important implications for you as a business owner. Chief among them is that you need to have a sellable asset when opportunity strikes.

Statistically speaking, the two most common reasons you are likely to sell your business are:

- A health scare;

- An unsolicited offer to buy your business.

As unsolicited offers increase, so too does the need for you to be ready if an opportunity comes your way. Unlike when the owner is in control of when he/she decides to list a property, the hallmark of an unsolicited offer is the fact that the owner doesn’t’ know when it is going happen; which means you need to operate your business as if an offer were always around the corner.

Companies that are sloppily put together with shoddy bookkeeping or too much customer concentration, or that are run by a Hub & Spoke manager, will end up being passed over for turnkey operations.

The time is now for you to get your company ready to showcase when opportunity comes knocking.

Why not find out now if your business is sellable?

This free online tool is the only no-risk step you can take to determine if your business is ready to get full value. Fast-track your analysis by taking advantage of this free, no-obligation free online tool.

This Sellability Score you instantly receive is a critical component to any business owner’s complete financial plan and is something that, until now, we have only made available to existing clients.

However, we recognized that there is value in knowing in advance of working with a financial planner whether or not your largest asset is ready to be exchanged for your retirement nest egg. Our view is that you are better to learn more about your businesses sellability today and find out how your business scores on the eight key attributes so that you can ensure you obtain full value.

If your business part of your retirement plan, finding out your sellability score will be the best 10 min. you could ever spend working “on” your business.

Take the Quiz here: The Business Sellability Audit

For more free information on Creating A Business Owner’s Dream Financial Plan, you can listen to a free, eight part series we did exclusively for business owners. The show is also available to subscribe to for free via iTunes.

For more free information on Creating A Business Owner’s Dream Financial Plan, you can listen to a free, eight part series we did exclusively for business owners. The show is also available to subscribe to for free via iTunes.